Negotiating the Price of a New Car

Should you pay sticker price for a new car – Purchasing a new car is a significant financial commitment. Understanding the negotiation process and market dynamics is crucial to securing the best possible price. This section will explore various factors influencing dealer flexibility, effective negotiation tactics, and the impact of market conditions on new car pricing.

Dealer Profit Margins and Negotiation Flexibility

Dealers typically operate on relatively thin profit margins, often ranging from 1% to 3% of the vehicle’s sticker price. However, additional profit comes from financing and add-ons like extended warranties. Several factors influence a dealer’s willingness to negotiate. High demand for a specific model reduces their incentive to discount, while slow-moving inventory might make them more flexible. The dealer’s overall sales targets and individual salesperson commissions also play a role.

A dealer nearing their monthly sales goal may be more willing to negotiate to close a deal.

Effective Negotiation Tactics

Effective negotiation requires research and a confident approach. Start by researching the market value of the vehicle you desire using online resources and comparing prices across dealerships. Knowing the manufacturer’s suggested retail price (MSRP) and invoice price is crucial. Armed with this information, you can confidently propose a price that aligns with your research and the dealer’s potential profit margin.

Being prepared to walk away if the negotiation isn’t fruitful can also be a powerful tactic.

Generally, paying the sticker price for a new car isn’t advisable; dealerships often have room for negotiation. To determine a fair price, it’s helpful to research the market value and understand the typical price to pay for new car for your chosen model. This research empowers you to negotiate effectively and avoid overpaying, ultimately securing a better deal than simply accepting the sticker price.

Comparison of Negotiation Strategies

| Strategy | Likelihood of Success | Time Commitment | Potential Savings |

|---|---|---|---|

| Researching market value and presenting a firm offer | High | Moderate | Significant |

| Playing dealerships against each other | Moderate | High | Moderate to Significant |

| Negotiating financing separately from the vehicle price | High | Moderate | Moderate |

| Waiting until the end of the month or quarter | Moderate | Low | Moderate |

Market Conditions and Their Impact on Pricing

The automotive market is dynamic, with supply and demand significantly impacting pricing. Economic factors also play a crucial role, influencing both consumer purchasing power and dealer pricing strategies.

Supply, Demand, and Economic Climate

High demand coupled with low supply, often seen during periods of economic growth or with popular models, typically leads to less negotiation flexibility. Conversely, during economic downturns or when a particular model is slow-selling, dealers may be more willing to negotiate to move inventory. Popular models tend to hold their value better and command higher prices, whereas less popular models often offer more room for negotiation.

Market Conditions and Negotiation, Should you pay sticker price for a new car

- High Demand, Low Supply: Limited negotiation power for buyers.

- Low Demand, High Supply: Increased negotiation power for buyers.

- Economic Boom: Higher prices, less negotiation.

- Economic Recession: Lower prices, more negotiation.

- New Model Release: Potential discounts on outgoing models.

Financing and Incentives: Impact on Overall Cost: Should You Pay Sticker Price For A New Car

Financing and manufacturer incentives significantly influence the final cost of a new car. Understanding these factors is crucial for making informed decisions.

Financing Options and Incentives

Buyers typically have several financing options, including loans from the dealership, banks, and credit unions. Manufacturer incentives, such as rebates and low-interest financing, can significantly reduce the purchase price. It’s important to compare interest rates and loan terms from different lenders to find the most cost-effective option. Longer loan terms result in lower monthly payments but increase the total interest paid over the life of the loan.

Financing Option Comparison

| Lender | Interest Rate | Loan Term | Monthly Payment (Example) |

|---|---|---|---|

| Dealership Financing | Variable (Example: 6%) | 60 months | $XXX |

| Bank Loan | Fixed (Example: 4.5%) | 72 months | $YYY |

| Credit Union Loan | Fixed (Example: 4%) | 48 months | $ZZZ |

New vs. Used: The Value Proposition

The decision between a new and used car involves weighing the benefits and drawbacks of each. Depreciation rates, maintenance costs, and overall cost of ownership are key factors to consider.

Depreciation and Cost of Ownership

Source: com.au

New cars depreciate significantly in the first few years, losing a substantial portion of their value. Used cars depreciate at a slower rate after the initial drop. Certified pre-owned (CPO) vehicles offer a compromise, providing some of the benefits of a new car with lower depreciation. For example, a new Honda Civic might depreciate by 20% in the first year, while a used Civic of similar age might depreciate by only 10% in the same period.

A visual representation comparing total cost of ownership over five years could show a steeper curve for the new car due to higher initial cost and depreciation, while the used car curve would be less steep, reflecting lower initial cost and slower depreciation.

Hidden Costs Beyond the Sticker Price

Beyond the sticker price, several additional fees can significantly increase the total cost of a new car. Understanding these hidden costs is crucial to avoid unexpected expenses.

Potential Hidden Costs

- Taxes and registration fees

- Dealer preparation fees

- Destination charges

- Extended warranty costs

- Optional add-ons (e.g., paint protection, window tinting)

- Financing fees

Long-Term Ownership Considerations

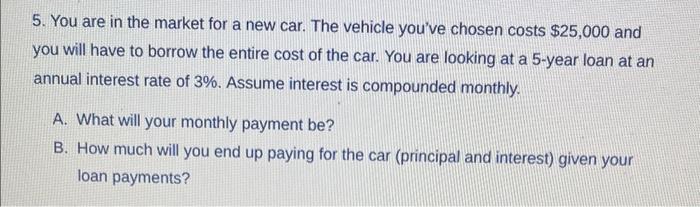

Source: cheggcdn.com

Long-term ownership costs extend beyond the initial purchase price. Fuel consumption, insurance premiums, maintenance, and repairs all contribute to the total cost of ownership. Choosing a reliable vehicle with lower maintenance costs is essential for minimizing long-term expenses.

Calculating Total Cost of Ownership

Calculating the total cost of ownership over five years involves adding up the initial purchase price, depreciation, fuel costs (based on estimated mileage and fuel efficiency), insurance premiums, maintenance and repair costs (considering the vehicle’s reliability and potential repair history), and any other relevant expenses. For instance, a vehicle with high fuel consumption and a history of costly repairs will have a significantly higher total cost of ownership compared to a more fuel-efficient and reliable model.

This calculation highlights the importance of considering long-term costs when choosing a vehicle.

Question & Answer Hub

What is the average dealer markup on a new car?

Dealer markups vary, but a typical range is between 1% and 10% above invoice price, although it can be higher or lower depending on the model and market conditions.

How long should I spend negotiating?

The time commitment varies. Be prepared to spend a few hours, possibly longer for complex deals. Don’t rush; a good deal is worth the effort.

Can I negotiate the price of a car during a high-demand period?

Negotiating is still possible, though your leverage might be reduced. Focus on financing options and incentives instead.

What are some common hidden fees I should watch out for?

Watch for dealer prep fees, document fees, and various administrative charges. Always ask for a complete breakdown of all fees before signing.